On Saturday (yes, Saturday), the Treasury Select Committee published its report on the 10p tax fiasco. And even though many feel this Committee is little more than a Labour mouthpiece, it lets fly:

On Saturday (yes, Saturday), the Treasury Select Committee published its report on the 10p tax fiasco. And even though many feel this Committee is little more than a Labour mouthpiece, it lets fly:

"For personal tax decisions, the sudden and final nature of Budget decisions has been... about the perceived benefit of seeming to pull rabbits from the hat."

Spot on. Mr Brown was apparently so fixated on his headline grabbing cut in the basic rate of income tax, he didn't worry about the poor people who were to fund it.

Ah, he suggested as the rotten eggs later started coming in, ah, these things are immensely complex, and I and my ministers hadn't realised so many people would lose. Cuh! Our clothead civil servants didn't do their sums properly... what can you do? You can't get the staff. We'll put things right immediately... here's an extra £2.7bn I've suddenly found... that'll fix things. The Committee lets rip:

-

- Treasury civil servants did all the right sums, and ministers were fully informed: "Mr Nicholas Macpherson, Permanent Secretary to the Treasury, told the Committee of Public Accounts that “a thorough distributional analysis was done” regarding the impact of the abolition of the 10 pence rate of income tax and that “Ministers took decisions on the basis of that analysis”

-

- The £2.7bn was a panicky response that still leaves nearly 1m poor losers, and of which £2bn goes to people who hadn't lost in the first place

- The £2.7bn only covers this year - what happens then?

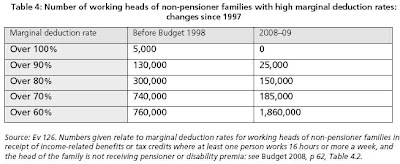

More generally, as we've blogged before, Brown's hugely expensive and hugely complex poverty programme has still managed to leave millions of people with crippling effective marginal tax rates. And as the Committee's summary table (above) shows, one very interesting feature is that, while the numbers on the very highest effective marginal rates have been cut - which is good - the numbers on rates above 60% have ballooned- which is v v bad.

Let's be clear: raising the personal tax allowance is the right way to tackle the poverty trap. Ideally, people should not enter income tax at all until they are earning at least say £10,000 pa. But the way Brown was forced into this very limited, and possibly temporary, increase epitomises the grubby underhand approach he followed throughout his time at No 11.