Those HMRC staff cuts

Yes, the PM can blame the junior official who downloaded the data and sent the discs through the ordinary mail. But come on. How on earth was it possible for him to do it? What's to stop a criminal gang member getting a job round at HMRC and just helping himself? How do we know it hasn't happened already? The entire set-up is a shambolic disgrace.

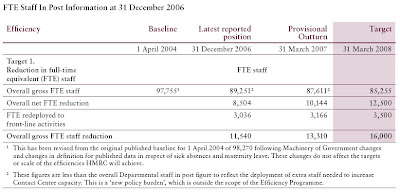

And from what we know so far, it looks like a major factor was the impact of staff cuts. As HMRC's Annual Report shows, since 2003-04, the department has cut over 10,000 staff (net, full-time equivalent), with a further 2,500 going this year.

These cuts are part of the Gershon "efficiency" programme, very familiar to regular BOM readers, and the personal idea of one G Brown. It was his blunderbuss scheme to make government more cost effective by cutting spending and staff so as to "release resources for the frontline".

He launched it amid much fanfare in the 2004 Budget, with the following ambitious targets:

And from what we know so far, it looks like a major factor was the impact of staff cuts. As HMRC's Annual Report shows, since 2003-04, the department has cut over 10,000 staff (net, full-time equivalent), with a further 2,500 going this year.

These cuts are part of the Gershon "efficiency" programme, very familiar to regular BOM readers, and the personal idea of one G Brown. It was his blunderbuss scheme to make government more cost effective by cutting spending and staff so as to "release resources for the frontline".

He launched it amid much fanfare in the 2004 Budget, with the following ambitious targets:

Right from the off, it was a classic top-down exercise visited on departments, with very little practical idea how the cuts could be achieved down at ground-level. So right from the off, departments used every trick in the Sir Humphrey playbook to deliver their targets without necessarily making real cuts. Which is why BOM has always been very sceptical about the overall savings (eg see this blog, and many others).

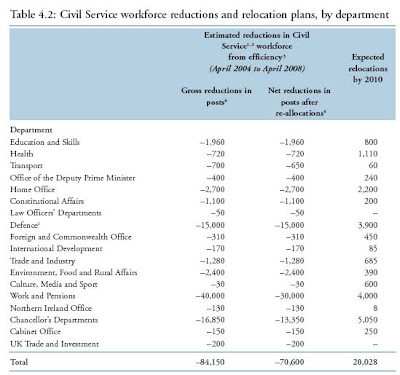

Since 2004, in every budget and pre-budget report, we've been given an update on supposed progress. By October this year, according to Darling's Pre-Budget (pre-aborted election) Statement, the Gershon programme had delivered "annual efficiency gains of over £20 billion... and is on track to deliver the goal of £21.5 billion by the end of March 2008". Moreover, there have been "gross reductions of over 79,000 civil service and administrative and support related military posts towards the target of 84,150, with over 13,000 of these reallocated to frontline roles" (para 3.28).

But according to the Public Accounts Committee, based on the most recent National Audit Office probe (see this blog), only one-quarter of the reported cuts are "reliable". By implication, the rest are a figment of the commissars' fertile imagination.

So on that basis, of the claimed £20bn savings, real savings are only about £5bn.

But even those "savings" have come at a considerable cost in terms of service quality. For example, the PAC found that "savings" at the Department for Work and Pensions had increased the average time taken to process Jobseeker’s Allowance claims from 11 days to 16 days. And the Department of Health, while reporting over £1 billion of efficiency gains from reducing the average length of time patients stay in hospital, had taken no account the fact that emergency readmissions had risen consistently.

The very worst cases have been where cuts have been imposed in areas already struggling with other changes.

For example, last year, we had the fiasco at the Rural Payments Agency (eg see this blog). There, a quango was attempting to develop and implement a brand new, highly complex, and IT-intensive farm payments system, at the same time as Gershon cutting 45% of its staff (see this blog). The combined effect was disastrous. RPA staff were reorganised into specialisms, rather than the previous "case-working" structure, because that seemed to be more efficient. But it meant that there was no fallback when the new IT systems failed. The old experience and knowledge had simply been discarded.

And taxpayers had to pick up a big tab to put things right- around £0.6bn, including a £436m fine from the EU for failing to meet their deadline (see this blog). In other words, the Gershon "savings" ended up costing us money.

And now we have HMRC.

As we blogged yesterday, the problem goes beyond a simple matter of staff cuts. Just like at the RPA, there are also new IT systems, and there are new "lean production" work patterns being imposed- less case working, and more specialisation (aka dumbed down production line jobs). It's a toxic combination, and staff morale is rock bottom (there is a dedicated chat room for HMRC staff called Disgruntled Lemmings- mysteriously "unavailable" at present).

Now, as taxpayers, we naturally applaud any sensible moves to make government more efficient. But imposing arbitrary staff cuts ahead of securing the IT systems required to support them is a recipe for disaster. And a shortcut to even higher costs.

Let's just think the unthinkable. Let's suppose these data discs have fallen into criminal hands. What will it cost us?

The going rate for bank account details on the international crime market is reportedly around £200 each. We don't know how many of these lost 25m records include bank accounts, but given what we do know, 5-10m seems a reasonable guess. Which means the black market value of these two discs is an extraordinary £1bn - £2bn.

But if their black market value is £1-2bn, you have to believe the likely loss from bank accounts is a multiple of that. We have no idea what multiple, but five-times is as good a guess as any other. Which means a bill of £5-10bn. A ten-times multiple means £10-20bn.

And who do you think will pay? It won't be the banks, despite the impression Bottler and Darling have sought to give. It will be us taxpayers.

And the cost doesn't end there. Everyone will need a new bank account (if you've been claiming Child Benefit in the last five years and haven't switched yet, do it tomorrow). Everyone may need a new National Insurance number. And for the next 18 years children hitting 18 will need to check their credit records to make sure someone isn't applying for credit in their name.

And we taxpayers will have to make good all the losses. Which will hugely outweigh the savings made from the Gershon cuts.

You know, it may be time we stopped politicos playing with blunderbusses altogether.