At the Northern Crock, taxpayers remain on the hook for £25bn of loans and a further £15bn plus of guarantees for depositors (see previous blogs here, here, and here, and this Treasury statement which spells out that the guarantee applies not only to retail deposits, but unsecured wholesale deposits as well).

So what do we now know about the Branson (see this blog) and Luqman Arnold escape plans (see here)?

The short answer is precious little. What we have been told is that neither is offering to repay anything like the whole £25bn we're owed on Day One. Branson has offered £11bn, and Arnold £10-£15bn, but since neither seems to have entirely tied up the commercial banks to provide the money, there isn't a whole lot to choose between them. They are both planning to keep £10-£15bn of our cash to be repaid at some stage over the next few years, effectively on a best endeavours basis. And in an environment where house prices may well be sogging drastically.

Moreover, taxpayers need to remember a very important point- our loan to the Crock is in two parts. Around £11bn seems to be secured against mortgage assets. But the rest- the bulk- is unsecured. And this being the real world, we can be pretty sure that both Branson and Arnold are proposing to repay the secured debt first. By "unencumbering" £11bn of mortgage assets in that way they will be be able to reuse them to secure more borrowing from commerical banks.

Unfortunately, that leaves taxpayers standing in line with all the other unsecured creditors for repayment of the other £15bn. And according to that leaked NR sales memorandum (see this blog), £74bn of the Crock's £90bn mortgage assets are already "encumbered" (ie pledged as security to existing lenders). So the unsecured lenders are pretty thinly covered.

In reality, we will only get our unsecured loans back anytime soon if NR's retail deposits base can be rebuilt, with fresh deposits being used to repay us. But is that in any way feasible? And more specifically, is it feasible without a continuation of the government deposit guarantee?

Both bids seem to envisage keeping that guarantee in place for "a period". Darling's plan had been to step away under cover of an increase in the general bank deposit guarantee up to £100,000. But that's now being opposed by the commerical banks on cost grounds (see here), so it looks very much like taxpayers will be staying on the hook.

True, Branson's bid does look the likelier of the two to survive without the guarantee. Whatever the City may think, many members of the public do seem to trust him, and since he launched his bid, NR's loss of deposits has reportedly dropped from about £200m per day to roughly zero. Arnold has no such credibility, and his intention to stick with the busted Crock brand looks like pie in the sky.

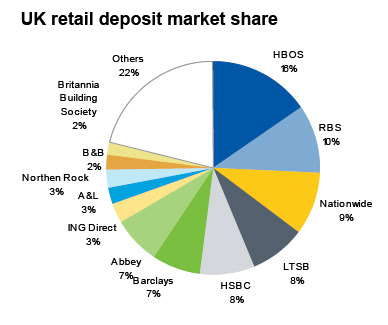

And even with the Branson bid, does anyone seriously imagine Virgin could capture a quarter of all new UK retail deposits, as apparently envisaged in their plan? Just take a look at the deposit market breakdown pre-crisis, with NR on just a 3% share:  Source: British Bankers Association

Source: British Bankers Association

As we've said many times before, it's very difficult to imagine taxpayers escaping intact from this fiasco. And at the end of the day, it may very well be that nationalisation and an orderly run-off is the best we can expect.

But what we should not accept is a deal where we continue to underwrite the bank while existing shareholders retain a stake. If the bank can't survive without state support, it's effectively bust, and shareholders must lose everything. Taxpayers should never be forced to bail out shareholders.

These two bidders should be asked to reshape their bids so that taxpayers are taken out whole soonest- no continuing loans, and no continuing guarantees.

If they can't do so, then Kaletsky nationalisation is the least worst option: the government gives notice that all loans must be repaid in full by end-February (including rolled up interest); failure to do so means Northern Rock will be nationalised for £1, depositors paid out, the assets sold off over a period of time, and the entire operation closed down.