For taxpayers the New Year has brought no good news on the Crock. Brown and Darling are still dithering in the headlights, while we remain on the hook for over £50bn of loans and guarantees. Hopes of a cost-free exit diminish by the day.

There is now no chance of the Virgin or Olivant "bids" working for us- they have been unable to raise the £10-15bn they claimed, and as we've blogged before, that wouldn't have been enough to pay off taxpayers anyway.

In an attempt to bridge the gap, Goldman Sachs was hired by the Treasury to come up with alternative finance, but if the leaks are to be believed, they've failed. Restructuring the £25bn taxpayer loan as a bond issue, which would then be sold to private investors, would only work with a taxpayer guarantee, or a prohibitively expensive "credit wrap" from a commercial insurer. Which gets us precisely nowhere.

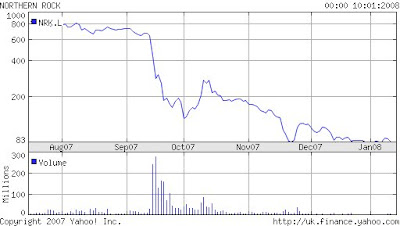

Meanwhile the raw meat eating hedge fund players who bought up c 20% of NR's equity stock back in September and October, are threatening to sue us when we nationalise the bank without compensation. They reckon we should pay them around £4 per share, which is the Bank's notional book value. Just to highlight how ludicrous that is, here's the share price chart:

They're also attempting to stop the existing NR directors "succumbing to political pressure", in particular by selling off assets to repay the Bank of England loans.

And on that point, the Rock last week did indeed sell a £2.2bn mortgage portfolio to Tony Blair's new employer, JP Morgan. These were well secured "equity release mortgages", and among the Bank's most high quality assets. Yes, they made a £50m profit against their book value, but we can understand why the shareholders are concerned they may have been sold off cheap.

Taxpayers should be concerned about exactly the same thing. As we all surely understand by now, the Bank only remains in business because of our loans and guarantees. And when we finally have to pick up the pieces, we do not want to find all the Canalettos and the Georgian silver have already been flogged in a fire sale.

The end-game is now clear. It's a state managed work-out. Darling has to nationalise the Bank without compensation, repay depositors, sell off the assets, and close down operations (as set out eg by Anatole Kaletsky two months ago).

One reason he's been holding back is that he doesn't want the embarrassment of adding NR's £100bn liabilities to the National Debt. According to this morning's Telegraph, he's therefore pursuing some kind of partial nationalisation.

That would be a serious mistake. Not only are the National Debt figures a fiction anyway (see many previous blogs), we've had more than enough confusion already, which has cost taxpayers a fortune. Simplicity, transparency, and tough decisions are what's needed now.

We learned over the weekend at least he's appointed someone to run the nationalised bank- ex-Lloyds head Ron Sandler. So now he just needs to pull the trigger.

And the longer he leaves it, the more it's going to cost us.