We've blogged before about selling the family silver. In the Earl of Stockton's immortal words:

"First of all the Georgian silver goes. And then all that nice furniture that used to be in the salon. Then the Canalettos go."

Very distressing for all concerned. But even more distressing when you let it go too cheap.

We've just had the National Audit Office report on the bungled sale of QinetiQ, previously the Defence Evaluation and Research Agency (DERA). It confirms our worst fears- taxpayers lost a packet.

Briefly, in 2003 the government sold a stake in QinetiQ to private equity players, the Carlyle Group. Their job was to act as a "strategic partner" to help get the company ready for floatation on the stock market. That duly came in 2006, when Carlyle sold its stake for a large profit.

-

- Carlyle got in too cheap, or in NAOspeak, "we consider that more money might have been raised from the 2003 sale to Carlyle, which generated total proceeds of £155 million" (para 13)... "weak competition (see paragraph 2.10) and the negotiated reductions in value (see paragraph 2.26) suggest that greater proceeds might have been achievable from the sale to Carlyle" (para 4.12)

-

- MOD bungled the sale by failing to agree a key longterm contract with QinetiQ before appointing Carlyle as preferred bidder (cf Virgin's appointment as preferred bidder on the Crock); because of that and other loose ends, Carlyle was able to beat down the price by £55m from their initial valuation after becoming preferred bidder (para 6)

-

- Senior management got far too much gravy - huge helpings of equity were made available to senior management in a juicy incentive scheme developed by Carlyle, with virtually no input from MOD (see below); in NAOspeak "we consider that the returns in this case exceeded what was necessary to incentivise management" (para 9)

- Wild inequity between taxpayers and "partners" Carlyle- "We have calculated that the Department made a notional internal rate of return of 14 per cent from the privatisation" (para 14).... "Carlyle made an internal rate of return of 112 per cent on their investment in QinetiQ" (para 15)

In other words, the catastrophic combination of politicos keen to raise some dosh, and bureaucrats incapable of commercial implementation has once again cost taxpayers a packet

Their dire performance is really underlined when you read the NAO's recommendations to avoid future problems. They are such statements of the bleedin' obvious that you'd blush to mention them to a six year old. Eg:

"If marketing activity demonstrates that there is limited interest in the opportunity, the public sector should reconsider the timing and structure of the proposed deal. In the public sector the impetus is often to press ahead in difficult circumstances rather than to attempt to maximise proceeds. It is not unusual for private sector deals to be postponed if the market is less favourable than anticipated."

Well, who could possibly have known that?

Clearly, MOD had no idea whatsoever about normal practice in the real world, and in all probability nobody was interested in finding out. The job was not to maximise taxpayer value but to satisfy Whitehall's asset sale target. Whatever the cost.

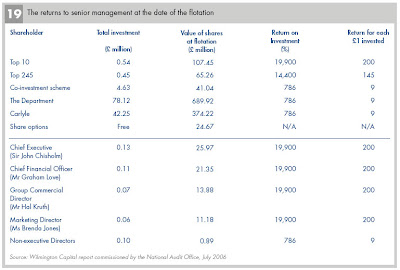

As for those laughing-all-the-way-to-the-bank senior managers... just like Cedric the Pig and the other civil servants who cashed out when the utilities got privatised, the boys at QinetiQ had the luck of Larry. Not only were they sitting in the chairs when the music stopped, defence and tech stocks performed extraordinarily well between them getting wedged and the floatation. Here's the NAO's table of who got what between the 2003 sale and the 2006 floatation:

As we can see, Carlyle made £332m and the executive directors made gzillions. CEO Sir John Chisholm creamed off £26m, a return on his initial investment of 19,900%. Nice work if you can get it.

As we can see, Carlyle made £332m and the executive directors made gzillions. CEO Sir John Chisholm creamed off £26m, a return on his initial investment of 19,900%. Nice work if you can get it.

So much for the grisly facts, but there's another very interesting aspect of this report. For the first time in living memory, the NAO has produced a report in which it records a serious disagreement between itself and the department under scrutiny.

Whitehall convention has been for the NAO and the department to lock themselves in a smoke-free room until they can agree a "form of words" to appear in the report. In effect, it's a joint report. That can be helpful because it means the PAC doesn't have to waste time trying to pin down the facts. But of course, the danger is obvious, and more than once, the truth has been smothered.

We saw that most dramatically in the case of last year's NAO probe into the NHS Supercomputer, when after a bitter Whitehall fight, the Department of Health nobbled the NAO report (see this blog). And the NAO has picked up a lot of flak about it ever since (eg see the Peter Oborne vid here).

Now, with Sir John Bourn on the way out, it looks like he's decided to throw cozy convention to the wind. Try this:

"4.12 The Department considers that its strategy to introduce a strategic partner maximised overall value and that seeking to achieve greater proceeds from the initial sale could have lowered eventual receipts. We recognise that the strategic partner model had benefits in improving the value of the business in advance of a flotation. We consider, however, that weak competition (see paragraph 2.10) and the negotiated reductions in value (see paragraph 2.26) suggest that greater proceeds might have been achievable from the sale to Carlyle. The Department and UBS Warburg disagree with this assertion. Various other indicators support our view."

The NAO's view is backed by a detailed analysis, including a revaluation of the company at the time of sale, subsequent performance relative to the market sector, and the fact that the net assets of QinetiQ were sold for less than their fair book value.

The MOD's response?

"The Department does not accept that the book value of QinetiQ at incorporation is a robust measure of the value of the business at that time and considers that it is not possible to derive an accurate estimate of the return it has achieved over the whole privatisation." (para 4.13)

It is not possible to derive an accurate assessment of the return it has achieved. Just think about that for a moment.

In effect, the MOD is telling us it sold an extremely valuable taxpayer asset to the private sector without having any idea what it was worth.

Would you do that?

Would a six year old child do that?

No, of course not.

But in Whitehall it's par for the course.

In the case of QinetiQ, MOD gave away £400-500m that rightly belonged to taxpayers. Yet nobody has been fired or resigned.

On 3 December, the PAC will be grilling MOD officials. We're booking our place now.