Politicians of all hues seem to assume we can go on increasing public spending by give-or-take 2% pa for ever. After all, the economy will deliver 2.5% pa growth, whatever, so what's the problem?

Politicians of all hues seem to assume we can go on increasing public spending by give-or-take 2% pa for ever. After all, the economy will deliver 2.5% pa growth, whatever, so what's the problem?

The problem is highlighted in one of the annexes to Wednesday's Budget, punchily entitled the Long-term public finance report: an analysis of fiscal sustainability. The age time bomb is ticking away quite nicely, with ballooning pensions, healthcare and long-term care set to wreck the public finances.

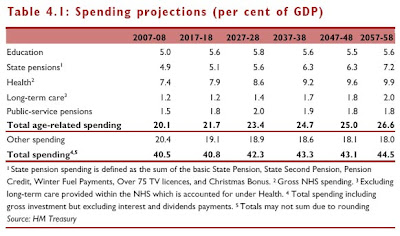

The table above summarises the Treasury's latest projections. As we can see, in the next half-century, age-related spending increases by 6.5% of GDP. That is a staggering amount, equivalent in today's terms to around £100bn pa, or £4 grand for every single household. It is principally driven by state pensions (an additional 2.3% of GDP), healthcare (an additional 3.3%), and long-term care (0.8%).

But here's the bad news: it's likely to be even worse than that. To start with, the Treasury assumes that we will all have the decency to die in a timely manner. By 2031, average life expectancy is assumed to be 82.7 for men and 86.2 for women. But judging by the experience so far, that might well turn out to be an underestimate (see this blog).

Second, the Treasury assumes unchanged policies. But just to take healthcare as one example, the experience of the last 50 years is that policy doesn't stay unchanged. Advances in expensive medicine are constantly putting upward pressure on spending. Similar pressures apply right across the public sector.

Third, it's well known that the relative cost of public services increases over time. That's because whereas public sector pay has to be kept broadly aligned with private sector pay, public sector productivity always trails far behind (eg slumping NHS productivity). Yet as far as we can see, the Treasury assumes the "unit cost" of public services relative to GDP remains unchanged.

Fourth, it is highly likely the Treasury's projections incorporate other hidden assumptions which damp down the increases. See that line "Other spending"? That goes down by 1.6% of GDP, with no very serious explanation why. And what precisely is being assumed on RPI vs earnings uplift for, say, pensions? Since earnings tend to outstrip prices over time, uplifting by RPI may understate the realistic prospective costs (we will investigate further).

The Big Message here is that demographic forces are propelling us towards a fiscal crisis. Even on the Treasury's figures, on current policies, public spending increases to 44.5% of GDP by mid century. Strip out that mysterious fall in "other spending", add on a bit for longer life expectancy, expensive new health technology, and low public sector productivity, and our back-of-envelope says that should actually read more like 50% (we'll be taking a closer look).

Now in theory, your reponsible politician considers this and says "hmm, looks like we'd better rein back on public spending asap, or we're going to be seriously up the fiscal creek".

But somehow in practice that never happens. The HMT Report concludes: "The UK will therefore be well placed to deal with the potential fiscal impacts arising from other long-term trends." So not exactly a call to action.

This government has talked a lot about fiscal reponsibility and something grandly called "intergenerational equity". We wonder whether a future working generation paying 50% tax with no pension before 80 will think equity has been achieved.