Did you know that 13% of UK adults face an effective marginal tax rate in excess of 70%? That is, for every additional £1 of income they get, the government will take at least 70p.

For 7% of adults it's even worse: they face an effective marginal tax rate of 90% plus, meaning they lose at least 90p of every extra £1 they earn.

So who are these people? Mega-wedged investment bankers busily inflating more debt balloons down at the Wharf, perhaps? Rock stars? Undeserving plutocrats having their pips squeaked by our Socialist rulers?

Ah, no. Worst case for all of those high-rolling groups is a marginal tax rate of 41%. The only people who face 80, 90, 100% tax rates are the poor.

That's because when they earn more, they not only have to pay tax, but they also face the progressive withdrawal of welfare benefits, such as housing benefit. Their Effective Marginal Tax Rate (EMTR) is consequently much higher.

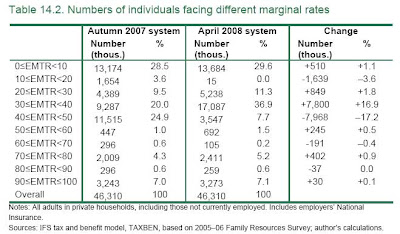

The latest facts are set out in the Institute of Fiscal Studies' Green Budget published in January. And here's their overall summary showing how many people are on different Effective Marginal Tax Rates (EMTR):

It's a depressing picture, and as we can see, Brown/Darling's latest 2008 tinkering has actually increased the proportion of taxpayers on the top marginal rates.

It's a depressing picture, and as we can see, Brown/Darling's latest 2008 tinkering has actually increased the proportion of taxpayers on the top marginal rates.

Labour has made much of its programmes to make poverty history. But as the IFS analysis so clearly highlights, in time honoured tradition, their approach has weakened incentives for the poor to help themselves. The Joseph Rowntree Foundation summarises the key IFS findings for people of working age thus:

"Work incentives are most weakened through the withdrawal of means-tested benefits and tax credits, not through high rates of income tax. Over two million workers in Britain stand to lose more than half of any increase in earnings to taxes and reduced benefits. Some 160,000 would keep less than 10p of each extra £1 they earned.

Overall, reforms under the Conservatives acted to strengthen average work incentives whereas Labour’s reforms to date have weakened financial work incentives on average: since 1999, tax and benefit changes have increased the average EMTR by almost three percentage points."

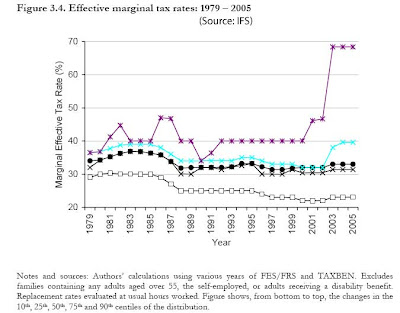

Another IFS paper charts the history. To understand what's happened, focus on the purple line: it shows the minimum effective marginal tax rate paid by the 10% of workers facing the very highest rates- they pay at least that much.

As we can see, under the Tories, the worst placed 10% of workers were those paying the 40% higher rate of income tax. Which is what we would expect. But since 1999, the worst placed 10% of workers are no longer those 40% income tax payers: rather, they are poor people facing crippling withdrawal rates on their welfare benefits.

This puts complaints about benefits scroungers into their proper perspective. No matter how much you and I may criticise them, for someone facing a 90% - or even a 70% - effective tax rate, working harder and longer is just not a rational option. And that feeling is reinforced when they hear tales of benefit recipients who've gone out to earn more, only to face later demands to repay hundreds of pounds in overpaid benefits: DWP's systems are simply unable to keep track of their earnings in the context of Brown's fearsomely complex benefits system.

Brown's means tested benefits for pensioners have similarly undermined incentives to save for retirement. Just at the time when another of his master-strokes (dividend tax) put the boot in on our company pensions, his pension credit system has blown the incentive to save in a personal pension. Why bother, if the government will only grab the benefit by withdrawing its own payments to you?

The reality of Gordon Brown's war on poverty is that by hugely expanding the scope and magnitude of means tested welfare benefits, he has made it much harder for the poor to earn their own way out of poverty. Even if they might want to. Despite all his talk about hand-ups replacing hand-outs, he has seriously reinforced long-term welfare dependency.