Now that our dithering "government" has finally pulled the trigger on nationalising Northern Rock, taxpayers are formally and irrevocably on the hook for up to £110bn (we don't know how much because we haven't seen any proper accounts for months).

For taxpayers, there are three key questions.

1. How bad is the loan book?

Despite constant government assurances that all its loans are "high quality", we have always feared NR's loan book will not stand up to a housing market downturn. With house prices now falling, our fears are being realised.

As we blogged last night, NR's mortgages in arrears leapt by 20% in the second half of 2007 and now stand at £1bn. Repossessions doubled in December, and mortgages worth more than the value of the property are increasing rapidly.

We don't know what we don't know, but the portents are grim. And we should remember that with the bank in public ownership, when it comes to taking losses, there are no longer any private sector shareholders ranking below us. A £10-20bn loss is quite conceivable.

2. Will we be forced to pay off shareholders?

The government says it will appoint an "independent valuer" to assess what if anything NR's shareholders should be paid for their stake. But as we've long argued, without the taxpayer bail-out NR would have gone bust months ago. The shares have been trading in a false market, and it would be outrageous if taxpayers are now made to pay compensation.

As for the hedge funds SRM and RAB suing the government for compensation, our wibbly wobbly government must somehow be strong. These funds bought in only after NR's problems surfaced, and their profits were always going to depend on facing the government down (cf Soros during the ERM crisis in 1992). They may argue that NR's net asset value is £4 a share, and threaten to sue for European Human Rights, but the government must be robust.

3. What's the corporate plan?

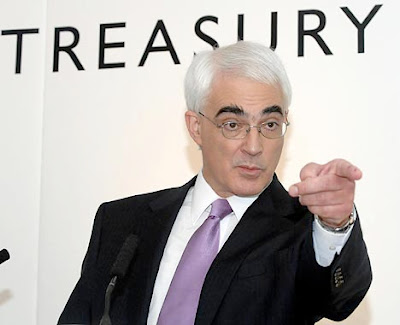

Darling told us yesterday:

"It is better for the Government to hold on to Northern Rock for a temporary period and as and when market conditions improve the value of Northern Rock will grow and therefore the taxpayer will gain. The long-term ownership of this bank must lie in the private sector".

That's very bad news for taxpayers. As we know only too well, there are no credible private sector buyers anywhere in sight, and market conditions are deteriorating. Taxpayers have had very bad experiences with nationalised companies and there's certainly no reason to think it will be any better under Brown and Darling. The least bad plan for taxpayers is to run-off the assets in an orderly way, and to close or sell the operation.

Let's hope new NR chief Ron Sandler, now being paid £90,000 per month to sort out the mess, understands the real world better than our rulers.

PS There are of course a number of other subsidiary questions taxpayers would like answered. Such as how much Goldman Sachs has been paid to come up with that dud financing plan?