Those egregious investment bankers, private equity gangsters, and hedge fund cowboys in the City have apparently helped themselves to £14bn! Just like that. Even though everyone knows they hardly lift a finger. 4,200 of them got bonuses of over £1m each! Shameful.

Closer to the real world, the Guardian has surveyed the scene in British boardrooms and reckons bosses are now getting 100 times what they pay their own workers! Although oddly the BBC has surveyed the same scene and reckons they're only getting 67 times more. Which would imply they're getting hundreds of thousands less than the Guardian figure...

Well, whatever. The main thing is they're getting a shed load of dosh and there's no way they deserve it. Impartial observer Brendon Barber says:

"This growing gap is not just morally offensive but hits workforce morale, feeds through into house price inflation and threatens social cohesion. Britain's boardrooms are slowly losing touch with reality."

Well, don't worry Brendon- reality is biting back. Because as you will also know, the same lib media has been chortling with delight at the thick black smoke pouring out of the credit markets. Mammon has hurled down one of his periodic thunderbolts on the unrighteous, bank profits are set to halve, the money changers are being slaughtered, and great is the rejoicing in the land. Those stinking piles of bonus ordure and long-term incentive evil will surely be cleansed from the face of the earth.

Ah. Well. Hmmm.

There may be one or two slightly less welcome knock-ons.

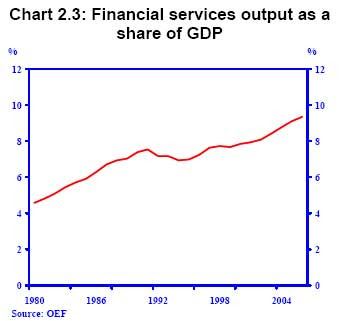

Jobs may go. The financial sector has grown massively over the last twenty years and now accounts for almost 10% of GDP (see here):

If that goes into reverse- as it did in the nineties recession- there'll be a world of pain. The City itself provides about 350,000 direct finance jobs, plus hundreds of thousands of support jobs. And in a credit crunch environment, the jobs outlook in other more traditional sectors would be little better.

None of which need worry Brendon Barber overmuch of course. As General Secretary of the TUC, around 60% of his 6.5m brothers and sisters work in the public sector (see here), so will be sheltered from the worst consequences.

Or will they? Because there is one small problem.

It turns out that - odious though they may be - those appalling bankers and other assorted high-rollers have been contributing one big fat wad of cash to the Treasury.

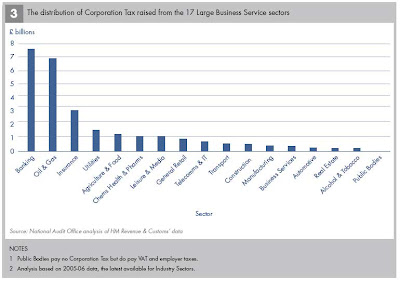

Consider this chart taken from the NAO Report we blogged yesterday. It shows which sectors paid most Corporation Tax in 2005-06:

As we can see, banking and insurance accounted for over £10bn in 2005-06, about one-quarter of the total. A 50% fall in their profits would therefore blow a pretty big hole in the Treasury's revenue forecasts - maybe £5-6bn. Plus, the corresponding cut in those bonus payments would slash personal tax receipts - PWC estimates that could cost another £2bn (see here). So we could easily be looking at a £7-8bn shortfall.

And Treasury finances are already rocky enough. After the spending binge, the hangover is heading our way (see many previous blogs). And as always, much of the pain will be felt on public sector pay.

The total public sector paybill is currently running at around £170bn pa, so every 1% increase costs around £1.7bn pa cumulative. Which is why last year Gordon Brown decreed future settlements must not exceed 2% (see this blog).

Sadly, the real world is a lot trickier than simply issuing a decree. For one thing, the government's own "independent" pay review bodies may award more than that, as they've done for both nurses and prison officers. Obviously government can respond with its usual dirty old-time incomes policy trick of "phasing" the awards, but nobody is fooled by that any more.

Anyway, aren't public servants grotesquely underpaid relative to those bankers and bosses? The BBC says they are.

All of which means strikes, even if they are illegal (yeah? wotyougonnadoabahtit?). And more Alan Johnson style pay cave-ins. A world of pain that will spill over to affect everyone.

So after all the promises, and all the money, we're right back to staring at another Winter of Discontent. And don't bank on this sun of manse making it glorious summer.

There's just one slim hope. Maybe those bankers can find some way to put out the fires, somehow keep the pain to themselves, and somehow keep the whole show on the road. Fingers crossed. Evil they may be, but boy, do we need them now.