Mervyn King has taken heavy flak over his handling of the banking crisis, especially from government politicians. For months he stood virtually alone in the corridors of power arguing that the bankers had made the profits, so they should reap the losses. Thank goodness he was there, because left to themselves our spineless politicos would long ago have given the bankers whatever they asked for.

This morning we finally got details of the Bank of England's new Special Liquidity Scheme to "unbung" the financial markets. And we have to say, it's less bad than we'd feared - King seems to have insisted on a degree of sanity being maintained.

As already leaked, the SLS scheme involves the authorities swapping our high quality Treasury securities for the banks' dodgy securities and loans - in particular those Residential Mortgage Backed Securities (RMBS) that nobody now wants. Stripped of technical jargon, we taxpayers are lending them £50bn (or more) secured against the collateral of a bunch of mortgage and other assets they will pledge to us. The arrangement will be for a 12 month period, extendable for up to three years.

From the taxpayer's perspective, the key questions are whether the collateral is secure, and what we are being paid.

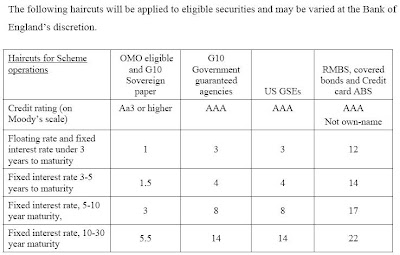

On security, the Bank has published the haircuts (ie discounts) that will be applied to the collateral (see table above). And as we can see, for mortgage and credit card based collateral, they will only accept the very highest quality (AAA as rated by two recognised credit rating agencies). And values will be discounted by up to 22% for quoted sterling denominated securities, with further discounts for unquoted or foreign currency denominated securities. What's more, the securities will be marked to market (ie repriced) daily, and collateral will need to be topped up if its value sags.

For choice, standing as we are on a property cliff-edge, we'd have preferred even harsher haircuts, but for AAA securities this is probably tough enough for taxpayers to at least snooze at night.

On charges, the banks will have to pay a fee. It will be equal to the difference between what they can already borrow at in the unsecured interbank market (3 month LIBOR), and what they can borrow at in the so called repo market, secured against government bonds. At present that difference is c 0.9% pa, which is therefore the fee they will be charged.

Again, for choice, we'd have preferred a higher fee: after all, we taxpayers are digging the banks out of a huge hole so we should get fully rewarded. But at least we're not giving them free money.

Overall, this deal seems a bit tougher on banks than some of last week's rumours suggested. And the equity markets seem to agree, with all the major banks' share prices down this morning. Which is reassuring.

And what will happen in the mortgage market? Darling and Brown will doubtless claim this move will "unbung" that as well, bringing "fresh hope to hardworking families and first time buyers". Don't believe a word of it. This is about giving the banks a breathing space to rebuild their capital and free up their balance sheets. Mortgage borrowers will not be high on their priority list.

Indeed, the Bank of England statement makes absolutely no mention of any deal with the banks to help mortgage borrowers. In fact, it makes quite clear that these new loans will not be provided against the collateral of any mortgage loans made since December 2007- so there is specifically no linkage with future mortgage lending.