We've been trying to uncover exactly what the government has promised to the banks. But so far taxpayers have been told very little.

Still, the bankers definitely know they're on a promise, as we can see from their share prices. For example, since Brown's crisis breakfast meeting on Tuesday, Barclays and HBOS are both up around 10%. That's a significant rise, and it underlines just how valuable they reckon Browns' promise is. On our reckoning, we taxpayers have given a £2bn present to HBOS shareholders (10% of their c£20bn market capitalisation) and a £3bn gift to Barclays. And that's just two of them.

These gifts are taking the form of credit risk on the mortgage portfolios we will be swapping for gilts. But what will taxpayers get in return?

There's talk of a "penal" fee for doing the swap, but as we learned from the Crock fiasco, such macho talk is most unlikely to translate into anything bankable.

Government spin says it will "free things up", ensuring cheaper and more available loans all round. But don't hold your breath: in practical terms the government won't have a prayer of ensuring benefits are passed on to customers, rather than being used to boost bank profits... not to mention those bonuses.

Moreover, given our wobbling crazed property bubble, many question whether yet more credit is what we want anyway. Sooner or later asset prices have to adjust, and postponing the hour may simply mean an even bigger bust in the future.

Of course, by then Brown's government may have gone. Leaving behind an even larger fiscal crater than we already have.

In the light of the £100bn Crock rescue, the omens for this latest deal are worrying. We have little confidence that the government will protect taxpayers interests, and we will need to scrutinise the details very carefully.

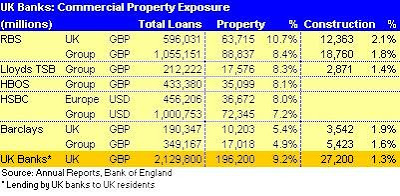

PS Driving through London this morning, I tried to do a quick crane count. Alarmingly, there are still so many I gave up - even though commercial property values are down 15% since last summer. The banks are naturally up to their gunwales in commercial property loans and the associated Commercial Mortgage Backed Securities (CMBS). So are we heading back to a 1990s style nuclear scenario? According to Fitch Credit Ratings, 10% of UK CMBS would go bust in such a world, and it could be a lot more (for even more anxiety, see this excellent FT Alphaville post).