When Lord Forsyth's Tax Commission reported 18 months ago, it called for tax cuts amounting to £21bn. Ed Balls and the BBC immediately savaged it: "same old Tories - same old destroying the NHS - same old killing babies and pensioners in the street" etc etc etc (eg see this blog). George Osborne hastily caved in, distancing himself from the Report, and pronouncing:

“We will not be promising reductions in taxation at the election. Any changes in taxes will be revenue-neutral.”

Yesterday Forsyth himself came back with an excellent speech at the IEA. The speech tackles head on the issue of how an incoming Tory government could fund such cuts.

First, he points out that cuts in tax rates do not necessarily mean proportionately smaller tax revenues. You don't have to believe in Voodoo Economics to understand the by now considerable evidence to show that lower tax rates increase GDP (see many previous blogs), which increases the tax base and naturally boosts revenues. There is also considerable evidence that lower rates generate less tax avoidance/evasion.

Forsyth quotes a number of US studies supporting these effects, including the work of surefire future Nobel laureate Prof Martin Feldstein. That concluded a 1 percentage point cut in personal marginal tax rates leads to an increase in taxable income by up to 2%. Which at current UK tax rates, suggests around two-thirds of the revenue foregone by cutting rates would be recouped via a revenue boost. And that's without considering longer term "dynamic" effects in lifting GDP growth.

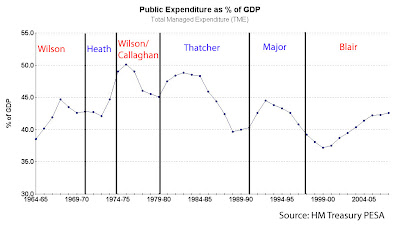

Second, tax cuts can be funded by containing the growth of public expenditure, and yesterday Forsyth suggested holding real growth to 1.5% pa during the first Parliament. He says:

"Matching Labour’s plans to increase spending by 2.1 per cent a year in real terms for the next three years was a mistake, but one which the Conservative Party is unlikely to have to implement as the Prime Minister will almost certainly go to the wire before calling a General Election. Far more important is whether any subsequent pledges to match the Government’s spending plans are made – if they are, they tie the Party into spending promises that could mean higher taxes or higher borrowing in a downturn."

We have long favoured the adoption of a third fiscal rule to contain the size of government (see eg here), so we wholeheartedly support Forsyth's call for an explicit upfront commitment. As he points out, 1.5% pa spending growth over a Parliament would almost certainly be enough to finance the whole of his proposed £21bn of tax cuts. And without destroying the NHS.

Finally, he takes a good whack at the slippery Mr Balls:

"Ed Balls is quite simply wrong – the price of not reforming our tax system is too great. Britain’s economy cannot continue to perform under the increasing burden of a higher, more complex, more uncertain and more unfair tax system. Political will and courage are now needed to grasp the nettle of reform."

PS ConservativeHome's spending campaign is getting more and more traction. Well done Tim and Sam- keep it up.