Downing St head banging

According to those overworked "sources", Darling has summoned the banks to the Treasury so he can "bang heads together" over the withdrawal of competitive mortgage offers and the failure to pass on the full quarter-point Bank of England rate cut".

Does anyone believe that?

The banks have provided a decade of cheap mortgage finance, much of it based on dodgy wholesale funding practices that sooner or later were going to go phut. Now they have. Cheap mortgages are over. The banks have to recoup losses and rebuild capital. Borrowers will pay the price in higher rates. Simple as.

Darling and Brown (who's arranged his own separate bangin' bankers breakfast meeting) are as usual playing to the gallery. They don't actually expect to change anything.

Much more worrying for taxpayers is the real possibility that the bankers will headbang the politicos into stumping up large wads of taxpayer assistance. Because these bankers know how to tell really scary stories, and spines are in somewhat short supply down Downing St way.

Consider the following Bank of England chart. It shows housing equity withdrawal - the amount of cash we have been withdrawing from our homes to spend (largely through remortgaging on the back of spiralling property prices).

Now, those figures are Big. With GDP running at £1400bn pa, housing equity withdrawal at £10bn per quarter amounts to 3% of GDP (it was even higher, at c5% in 2003-04). Or to put it another way, collapsing equity withdrawal - like we're now experiencing - is seriously undermining growth. The fall over the last 12 months has already cut GDP growth by 1% or so, and you'd have to guess the trend is continuing.

Now, those figures are Big. With GDP running at £1400bn pa, housing equity withdrawal at £10bn per quarter amounts to 3% of GDP (it was even higher, at c5% in 2003-04). Or to put it another way, collapsing equity withdrawal - like we're now experiencing - is seriously undermining growth. The fall over the last 12 months has already cut GDP growth by 1% or so, and you'd have to guess the trend is continuing.

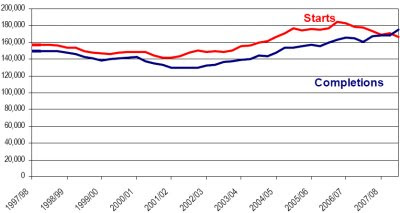

And we can add to that the fact that pricier mortgages means fewer buyers and less new housebuilding. The trend in new home starts has already turned down decisively and is bound to accelerate:

So the economic stakes are high. Combined with plummeting poll ratings, those bankers have more than enough material to scare our wobbly politicos.

And the bankers are hot on the case. On Friday, the Chairman of the Council of Mortgage Lenders (CML) warned that "tens of thousands of current borrowers and new buyers will be refused mortgages this year unless the Bank of England provides greater financial help to banks and building societies".

What does he mean by "financial help"? He says they want:

"...deeper and longer term repo facilities – extending beyond the 3-month facility to 12 months or perhaps even 24 months – would definitely begin to help to address lenders’ concerns."

In other words, more lending by the Bank of England against collateral. We agree with that, so long as the collateral is "aggressively" valued (ie heavily marked down) to give taxpayers a healthy safety margin if the borrower defaults (see this blog). He goes on:

"And kick-starting the market for new issuance of mortgage-backed securities – perhaps by incentivising the kind of stable, domestic investors such as pension funds that would fit this market well – is something that the CML believes the Bank should seriously consider."

Hmm... "incentivising investors". We don't like the sound of that. What kind of incentivising? We smell guarantees and special tax breaks.

And complaints about "the inadequate state support scheme for mortgage borrowers" make us very nervous. The state should not be in the business of shoring up borrowers who've been lent too much by go-go bankers (the Chairman of the CML just happens to be chief executive of Bradford & Bingley, Britain's biggest buy-to-let lender).

As we've said many times, by all means let's lend more to the banks against good collateral and at a suitably high rate. But bailing out bankers who've over-reached themselves is not something taxpayers should ever be made to do.

Amid all the head banging, let's hope our leaders don't do anything stupid.

Anything else stupid.